How to Invest in Nasdaq from India? Nasdaq is one of the most popular and influential stock exchanges in the world, home to some of the biggest and most innovative companies in various sectors, especially technology. Nasdaq India is a term that refers to the Indian investors’ interest and participation in the Nasdaq market, either directly or indirectly. In this article, we will explain what Nasdaq is, why it is attractive for Indian investors, and how to invest in Nasdaq from India.

What is Nasdaq?

Nasdaq stands for National Association of Securities Dealers Automated Quotations, and it is an American stock exchange that was created in 1971. It is the second-largest stock exchange in the world in terms of market capitalization, after the New York Stock Exchange (NYSE). As of July 2023, Nasdaq had more than 3,300 listed companies, with a total market value of over $21 trillion.

Nasdaq is known for being the first all-electronic stock exchange, which means that it does not have a physical trading floor, but rather operates through a network of computers and telecommunication systems. Nasdaq is also known for being the preferred choice of many leading technology companies, such as Apple, Microsoft, Amazon, Google, Facebook, Tesla, and Netflix. Nasdaq also lists companies from other sectors, such as consumer services, healthcare, industrials, and finance.

Nasdaq has several indices that track the performance of its listed companies, such as the Nasdaq Composite, the Nasdaq-100, and the Nasdaq Biotechnology. The most widely followed index is the Nasdaq-100, which consists of the 100 largest non-financial companies on the Nasdaq. The Nasdaq-100 is often used as a benchmark for the US technology sector, and it is also the underlying index for several exchange-traded funds (ETFs) and mutual funds.

Why is Nasdaq attractive for Indian investors?

Nasdaq is attractive for Indian investors for several reasons, such as:

- Diversification: Investing in Nasdaq can help Indian investors diversify their portfolios and reduce their exposure to domestic market risks. Nasdaq offers access to a wide range of companies from different sectors and countries, which can help investors benefit from global growth and innovation opportunities.

- Potential for high returns: Nasdaq has been one of the best-performing stock markets in the world, especially in the last decade. The Nasdaq-100 index has delivered an annualized return of about 31% in the last 10 years, compared to about 10% for the BSE Sensex. Nasdaq is home to some of the fastest-growing and most profitable companies in the world, which can offer significant potential for high returns for investors.

- Exposure to innovation: Nasdaq is the hub of innovation and technology, where many of the most disruptive and influential companies in the world are listed. Investing in Nasdaq can give Indian investors exposure to the cutting-edge technologies and trends that are shaping the future of various industries, such as e-commerce, cloud computing, artificial intelligence, biotechnology, and electric vehicles.

READ ALSO | Juniper Networks Bangalore: A Brief Overview of the Company and Its Operations in India 2023

How to invest in Nasdaq from India?

There are two main ways to invest in Nasdaq from India: direct investments and indirect investments.

Direct investments

Direct investments mean buying and selling the shares of the Nasdaq-listed companies directly on the Nasdaq exchange. This requires opening a brokerage account in the US or using an online platform that provides this option, such as Stockal or INDmoney. These platforms allow Indian investors to trade in US stocks without any account opening fees or commission on buying and selling. They also offer features such as fractional trading, which enables investors to buy a fraction of a share instead of a whole share, making it affordable to invest in expensive stocks.

The advantages of direct investments are that investors can choose the specific companies they want to invest in, and they can benefit from the full returns of the stocks. The disadvantages are that investors have to deal with the currency conversion costs, the tax implications, and the regulatory compliance of investing in a foreign market.

Indirect investments

Indirect investments mean investing in the Nasdaq market through mutual funds or ETFs that are either listed in India or the US. These funds invest in the Nasdaq-listed companies or track the Nasdaq indices, and give investors exposure to the US market.

The advantages of indirect investments are that investors can diversify their risk across a basket of stocks, and they can avoid the hassle of opening a US brokerage account or dealing with currency conversion and tax issues. The disadvantages are that investors have to pay a management fee to the fund managers, and they may not get the full returns of the stocks due to the tracking error or the fund expenses.

Some of the popular mutual funds and ETFs that invest in Nasdaq from India are:

- Motilal Oswal Nasdaq 100 Fund: This is an open-ended fund that invests in the Motilal Oswal Nasdaq 100 ETF, which tracks the Nasdaq-100 index. The fund has an expense ratio of 0.54%, and it has delivered a return of 32.5% in the last year.

- ICICI Prudential Nasdaq 100 Index Fund: This is an open-ended fund that invests in the stocks that constitute the Nasdaq-100 index. The fund has an expense ratio of 1.09%, and it has delivered a return of 31.6% in the last year.

- Aditya Birla Sun Life Nasdaq 100 Fund: This is an open-ended fund that invests in the units of the Invesco QQQ Trust, which is an ETF that tracks the Nasdaq-100 index. The fund has an expense ratio of 1.07%, and it has delivered a return of 31.4% in the last year.

Alternatively, investors can also invest in the Nasdaq ETFs that are listed in the US, such as the Invesco QQQ Trust, the ProShares Ultra QQQ, or the ProShares UltraPro QQQ, using the online platforms mentioned above.

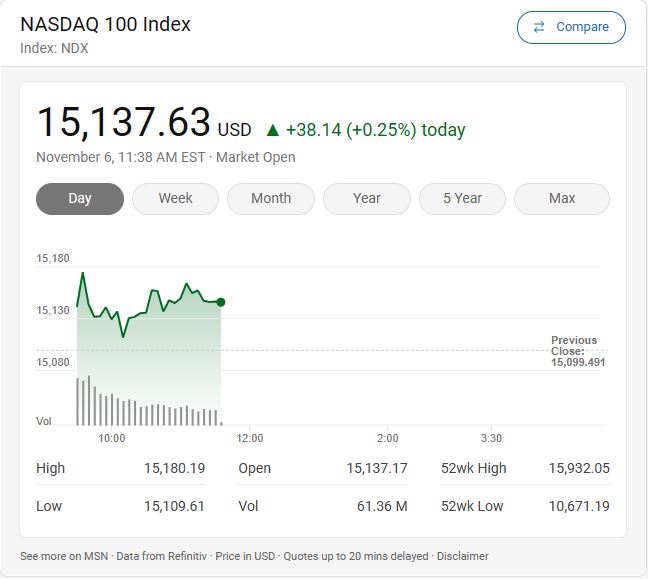

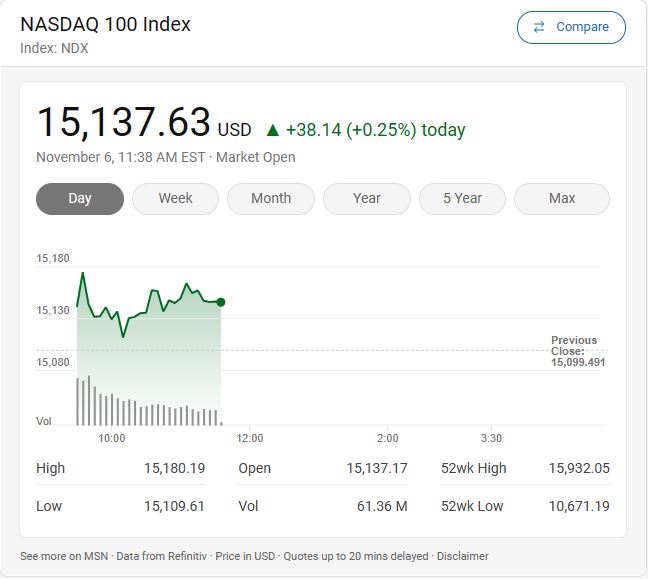

NASDAQ 100 Index

The NASDAQ 100 Index is a stock market index that tracks the performance of the 100 largest non-financial companies listed on the NASDAQ stock exchange. The index includes companies from various sectors, such as technology, consumer services, health care, and telecommunications. Some of the well-known companies in the index are Apple, Microsoft, Amazon, Google, Facebook, Tesla, and Netflix. The index is often used as a benchmark for the US technology sector, and it is also the underlying index for several exchange-traded funds (ETFs) and mutual funds.

How to Buy NASDAQ Shares

If you want to buy NASDAQ shares, you need to have a brokerage account that allows you to access the US stock market. You can either open a brokerage account in the US or use an online platform that provides this option, such as Stockal or INDmoney. These platforms enable you to trade in US stocks without any account opening fees or commission on buying and selling. They also offer features such as fractional trading, which allows you to buy a fraction of a share instead of a whole share, making it affordable to invest in expensive stocks.

Things to Consider Before Investing in NASDAQ from India

Before investing in NASDAQ from India, you should consider some key factors, such as:

- Diversification: It is important to diversify your portfolio when investing in NASDAQ. You can invest in different sectors, industries, and companies to reduce your risk and exposure to market fluctuations. You can also invest in NASDAQ through mutual funds or ETFs that track the index or specific sectors, which can help you spread your risk across a basket of stocks.

- Market conditions: Keep an eye on market conditions and the overall state of the economy. NASDAQ is influenced by various factors, such as interest rates, inflation, exchange rates, political and regulatory developments, and consumer sentiment. These factors can affect the performance and valuation of the NASDAQ companies and the index. You should also be aware of the market trends and cycles, and adjust your investment strategy accordingly.

- Company financials: Research the financial health of the companies you are considering investing in. Look at factors such as earnings, revenue growth, debt levels, cash flow, profitability, and valuation to help determine their long-term viability and potential. You can also compare the companies with their peers and competitors, and analyze their competitive advantages and disadvantages.

What are the advantages and disadvantages of investing in NASDAQ from India?

Some of the advantages and disadvantages of investing in NASDAQ from India are:

Advantages:

- You can diversify your portfolio and reduce your exposure to domestic market risks. NASDAQ offers access to a wide range of companies from different sectors and countries, which can help you benefit from global growth and innovation opportunities.

- You can potentially earn high returns by investing in some of the fastest-growing and most profitable companies in the world, especially in the technology sector. NASDAQ has been one of the best-performing stock markets in the world, especially in the last decade. The NASDAQ-100 index has delivered an annualized return of about 31% in the last 10 years, compared to about 10% for the BSE Sensex.

- You can gain exposure to the cutting-edge technologies and trends that are shaping the future of various industries, such as e-commerce, cloud computing, artificial intelligence, biotechnology, and electric vehicles. NASDAQ is the hub of innovation and technology, where many of the most disruptive and influential companies in the world are listed.

Disadvantages:

- You have to deal with the currency conversion costs, which can erode your returns. The exchange rate between the Indian rupee and the US dollar can fluctuate significantly, depending on the market conditions and the economic policies of both countries. You also have to pay a foreign exchange fee to your broker or platform when you buy or sell US stocks.

- You have to pay taxes on your capital gains and dividends, both in India and in the US. The tax rates and rules may vary depending on your income level, residency status, and the type and duration of your investment. You may also have to file tax returns in both countries and claim tax credits to avoid double taxation.

- You have to comply with the legal and regulatory requirements of investing in a foreign market, which can be complex and time-consuming. You have to follow the Foreign Exchange Management Act (FEMA) and the Reserve Bank of India (RBI) guidelines for investing in US stocks. You also have to adhere to the Securities and Exchange Commission (SEC) and the Internal Revenue Service (IRS) regulations for trading and reporting US stocks.

Conclusion

Nasdaq is one of the most attractive and influential stock markets in the world, and investing in Nasdaq can offer several benefits for Indian investors, such as diversification, potential for high returns, and exposure to innovation. Indian investors can invest in Nasdaq from India either directly or indirectly, depending on their preferences, goals, and risk appetite. Investing in Nasdaq can be a rewarding and exciting experience, but it also involves risks and challenges, such as currency fluctuations, tax implications, and market volatility. Therefore, investors should do their research, understand the pros and cons of each option, and consult a financial advisor before making any investment decisions.

Frequently Asked Questions FAQs:

Here are some possible FAQs:

- Q: What is Nasdaq?

- A: Nasdaq is an American stock exchange that is the second-largest in the world in terms of market capitalization, and the preferred choice of many leading technology companies.

- Q: What is Nasdaq India?

- A: Nasdaq India is a term that refers to the Indian investors’ interest and participation in the Nasdaq market, either directly or indirectly.

- Q: Why is Nasdaq attractive for Indian investors?

- A: Nasdaq is attractive for Indian investors because it can help them diversify their portfolios, benefit from global growth and innovation opportunities, and gain exposure to cutting-edge technologies and trends.

- Q: How can Indian investors invest in Nasdaq directly?

- A: Indian investors can invest in Nasdaq directly by opening a brokerage account in the US or using an online platform that provides this option, such as Stockal or INDmoney. These platforms allow Indian investors to trade in US stocks without any account opening fees or commission on buying and selling.

- Q: How can Indian investors invest in Nasdaq indirectly?

- A: Indian investors can invest in Nasdaq indirectly by investing in mutual funds or ETFs that are either listed in India or the US. These funds invest in the Nasdaq-listed companies or track the Nasdaq indices, and give investors exposure to the US market.

- Q: What are some of the popular mutual funds and ETFs that invest in Nasdaq from India?

- A: Some of the popular mutual funds and ETFs that invest in Nasdaq from India are Motilal Oswal Nasdaq 100 Fund, ICICI Prudential Nasdaq 100 Index Fund, Aditya Birla Sun Life Nasdaq 100 Fund, and Invesco QQQ Trust.

- Q: What are the advantages and disadvantages of direct investments in Nasdaq?

- A: The advantages of direct investments in Nasdaq are that investors can choose the specific companies they want to invest in, and they can benefit from the full returns of the stocks. The disadvantages are that investors have to deal with the currency conversion costs, the tax implications, and the regulatory compliance of investing in a foreign market.

- Q: What are the advantages and disadvantages of indirect investments in Nasdaq?

- A: The advantages of indirect investments in Nasdaq are that investors can diversify their risk across a basket of stocks, and they can avoid the hassle of opening a US brokerage account or dealing with currency conversion and tax issues. The disadvantages are that investors have to pay a management fee to the fund managers, and they may not get the full returns of the stocks due to the tracking error or the fund expenses.

- Q: What are the risks and challenges of investing in Nasdaq?

- A: The risks and challenges of investing in Nasdaq include currency fluctuations, tax implications, market volatility, political and economic uncertainties, and legal and regulatory differences.

- Q: How can Indian investors research and analyze the Nasdaq market and companies?

- A: Indian investors can research and analyze the Nasdaq market and companies by using various sources of information, such as the Nasdaq website, the company websites, the financial reports, the analyst ratings, the news articles, the podcasts, the blogs, and the forums.